The Benefits of Auctioning Commercial Property

If you own a commercial property you’re struggling to sell — or fear it might be difficult to sell quickly through traditional methods, — consider selling it at an auction. The right online auction and team can get your property in front of a wide range of qualified, interested buyers who are serious about finding and purchasing CRE quickly and efficiently. Team Lizzack-Horning has the experience you’re looking for and is ready to guide you through the successful process.

Advantages of Selling CRE at Auction

Selling a property via auction can move fast, with the process lasting approximately twelve (12) weeks from start to finish if everything is straightforward. Since sellers can set a reserve price at auction, the risk of selling a property for a perceived undervalue decreases. Sellers can also list multiple properties in the same auction and sell them simultaneously.

This strategy also gives certainty because once the auction ends and the gavel falls, the seller and buyer are legally committed to the transaction — with a much lower possibility the deal will collapse. All bidders have been vetted by the auction house to have the proof of funds.

Disadvantages of Selling CRE at Auction

Are there any drawbacks to selling CRE at auction? A few — but some challenges are the same as when selling CRE the traditional way.

- While you can set a reserve price, it doesn’t guarantee the property will sell at the price you hoped.

- There’s no guarantee the property will sell at all.

- You may still incur costs even if the property doesn’t find a buyer.

- A fixed timeline, which many people like, can also be restrictive, especially if problems arise, as neither the buyer nor seller has much time to resolve them.

Commercial property auctions offer a fast and convenient way to sell commercial real estate. The main advantage for buyers? The potential to get a good deal on a property. The main advantage for sellers? Auctions are ideal for those who need (or want) to liquidate properties — like foreclosures or estates — quickly.

Selling Your Property at Auction? Here’s What You Need to Know.

Purchasing CRE is faster than traditional methods but requires buyers to set up their financing ahead of time or after-the-fact. After winning an auction, buyers typically pay a non-refundable ten (10%) percent deposit at contract execution and closing takes place within 28 days thereafter. Businesses lacking enough cash on hand can, sometimes, use auction financing to bridge the gap.

Commercial property auctions often provide more transparency and clarity than traditional sales. Auctioneers and solicitors educate participants ahead of time on required documentation like title deeds, leases, and planning permissions. Bidders must submit the necessary paperwork before the auction date in order to receive bidding approval.

This upfront process yields a smoother, more convenient experience than many typical commercial purchases, which can lack transparency or have delays. Auction terms and qualifying criteria are clear and consistent for all participants. This streamlined approach allows confident bidding and decision-making and it can lower the chance a deal may fall through, too.

How the Process Works

When you’re ready to sell a commercial property at auction, you’re broadening your market and reaching more people. Here’s how the process generally works.

First, you’ll partner with a brokerage firm to auction your property. Brokers are essential to the process, working in partnership with the auctioning company. While the auction “house” will handle marketing, auctioning, and closing, brokering the deal is critical.

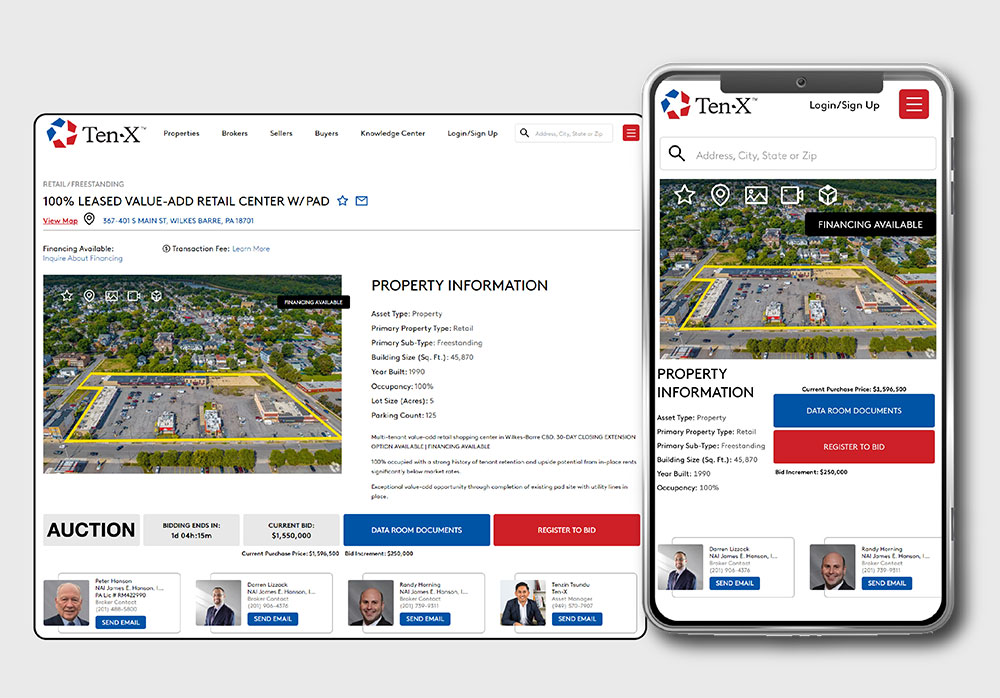

Team Lizzack-Horning works with the largest auction platform in the world, Ten-X,, an online commercial real estate exchange. Brokers and sellers use this digital platform to upload assets, review marketing campaign results in real-time and follow up on the strongest pre-qualified leads.

The onboarding process usually takes 7 to 10 days. During that time, the company (in our case, TenX) photographs your property inside and out — and possibly gets drone footage of the building and neighborhood.

They will provide third-party reports, including a property condition report, phase one report, and title commitment, with no upfront cost to the seller. You or your broker will provide other information like the financials, rent roll, offering memorandum (OM) and anything a would-be buyer would typically expect before deciding whether to participate in the auction. This process allows potential buyers to kick the deal’s tires before the auction opens. Buyers have enough information to make informed decisions whether to pursue the transaction if both buyer and seller agree upon price.

The auction company will also create a webpage for the specific property and then load it onto platforms such as LoopNet, Costar, Broker’s website, etc. to advertise it for several weeks prior to the LIVE auction. People can see the deal, review the information, and tour it virtually. Also, during this time, you or your broker might field calls from people interested in seeing the property in person.

Bidders are qualified or pre-qualified before the online auction occurs. They must show liquid proof of funds. For example, if you want to sell your property for $10 million (reserve price) and a bidder shows $25 million of liquid proof, they will likely get approved. If another bidder shows they have $10 million liquidity, they could also be approved for up to 110% of the agreed-upon $10 million reserve price. If it’s determined that a potential buyer doesn’t have the required capital to purchase the property, they won’t be permitted to participate in the auction.

The Key Takeaways

CRE online auctions have evolved into an important marketing tool, offering another place for sellers and buyers to connect and negotiate property sales efficiently, quickly, and transparently.

Choosing to sell your property via an online auction doesn’t mean it’s a fire sale. Many properties listed for sale are cash-flowing positive — not in trouble. Some investors want to sell so they can invest in a new, higher-yield opportunity. Others have sold, closed, or moved their companies and needed to sell. Sometimes, investors pressure building owners for their returns; and at other times, an investor has felt they’ve grown their property to its fullest potential.

Working with a digital platform like Ten-X has empowered Team Lizzack-Horning to increase our reach because we’ve got access to Ten-X’s vast contact database.

When we list your property with Ten-X, the company has 45 days to launch the information into the world. Buyers conduct all due diligence with our team’s help. Once the auction goes live, the only thing left to do is agree on the price.

By partnering with Team Lizzack-Horning, you benefit from a wider and more qualified buyer pool, a higher close rate and most likely increased pricing. The sale process is completely transparent since we conduct due diligence — including a preliminary title search — and offer a universal sale contract for buyers to review, eliminating negotiations. Ten-X develops and executes an individualized marketing plan customized for the asset(s) you’re selling and intended to attract the most qualified buyers being targeted.

If you’d like to learn more about how we can help you sell your CRE property, please contact us:

Darren Lizzack, MSRE

Vice President

O: (201) 488-5800, Ext. 104

C: (201) 906-4376

Randy Horning, MSRE

Vice President

O: (201) 488-5800, Ext. 123

C: (201) 739)-9311